The Japanese health ministry wants generics to account for 80% of prescriptions in the country by 2017 – but the country has one of the lowest uses of generics. There is some general suspicion of Generics in the US and yet it has one of the largest percentage use of generics – why the wide disparity?

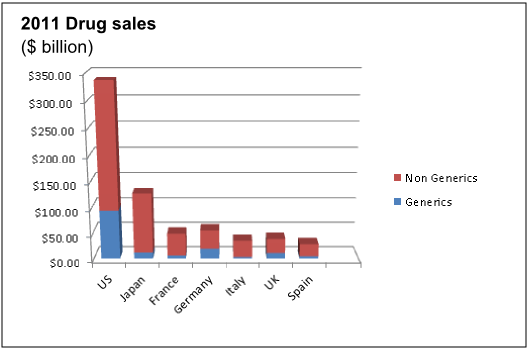

Back in 2011, generics accounted for more than eight of every ten prescriptions written in the US and yet in Japan – the world’s second-largest drug market – only two of those prescriptions would have been for generics. The graph below shows value sales so the US figures are skewed by high-value branded drugs but the difference is still striking.

The disparity is even more striking when you consider the way generics are priced in the two countries – generics typically costing 80% less than branded drugs in the US but only 20% cheaper in Japan.

The situation has changed in the last few years. Now almost half of Japanese prescriptions are for generics but still far short of the 80% target.

So is the perceived lack of saving a key factor?

Probably not, as Japanese patients with insurance may pay as little as 10% of the drug price so they are unlikely to really notice the difference.

All of this puts a lot of pressure on the Japanese healthcare sector, which has seen drug costs rising at three-times the rate of overall medical costs between 2009 and 2013.

The Health Ministry has come out in favour of generics, saying there is often no appreciable difference – but Japanese patients prefer branded drugs as they are perceived to be safer and more effective. Some Japanese doctors have also made media statements supporting branded drugs – prompting suggestions of undisclosed ties with the manufacturers.

One suggested solution is that patients can choose a branded drug in place of a generic alternative, but when they do, they must pay 100% of the branded drug price. Japanese drug prices are higher than in many other countries so this could be an effective deterrent – but I can’t see it being a popular move, especially in the branded drug sector.